Silicon Valley is far outpacing all other metro areas when it comes to companies leasing and moving into commercial space, a trend driven primarily by tech, according to a recently released report.

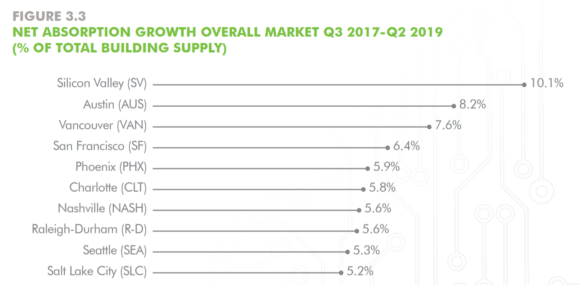

The trend, outlined in commercial real estate brokerage CBRE’s annual Tech-30 report, shows that even as many Bay Area companies increasingly look outside of the region for expansion space, buildings in the South Bay remain a hot commodity compared to other major metros. Between July 2017 and June 2019, Silicon Valley’s building supply saw a 10.1 percent net absorption growth.

“Net absorption is the easiest proxy for us as real estate analysts to measure demand,” said Lexi Russell, director of research and analysis for CBRE’s Mountain-Northwest division. “Having a high net absorption means you are having more companies move into space than move out.”

In Silicon Valley, one big driver of those numbers is all of the new construction rising in area in recent years, Russell added in an interview this week.

“The thing that we’ve seen in Silicon Valley that is helping with that is new construction has been pre-leased, and once it’s delivered, it’s fully occupied,” she said. “Basically, net absorption is a measurement for demand for space.”

Indeed, Silicon Valley — and in particular San Jose — has seen major demand that wasn’t always present in the past.

For instance, one of the two Riverpark Towers at 300 Park Ave. in downtown San Jose, stood empty for more than five years before the 16-story tower last year was declared fully leased.

On the north side of San Jose, hundreds of thousands of square feet of brand-new office space have been pre-leased by video streaming technology company Roku and telecommunications and media company Verizon at the still-under-construction Coleman Highline office park.

Meanwhile, two companies — HPE and Rambus — have decided to move their longtime headquarters from popular cities to the north to San Jose.

“The tech industry’s growth in Silicon Valley has reached a new, higher level with the largest tech firms making major real estate commitments to accommodate growth over the next 10 to 20 years,” said Todd Husak, managing director of CBRE’s Palo Alto office. “The convergence of talent, transportation and new development capacity has made downtown San Jose a new hotspot for the tech industry.”

Those new commitments in downtown San Jose have indeed been some of the biggest real estate stories of the year.

Google’s application to build a sprawling new tech campus was made public this year, as work got underway at San Jose-based Adobe’s expansion in the downtown core.

And even as millions of square feet of brand-new office space by Jay Paul Co. was scooped up this year by tech giants Facebook and Amazon at the Moffett Towers II project in Sunnyvale, the San Francisco-based developer was still eyeing up the South Bay city.

Last year, Jay Paul bought San Jose’s block-sized CityView Plaza at 125 S. Market St. in downtown and this year announced the company would demolish the mixed-use plaza to build a 3.4 million-square-foot tech campus. The developer has already started work on its property across the street at 200 Park Ave., where it is building a new office tower.

While San Jose has seen an especially meteoric rise in popularity with major companies and developers in recent years, all of Silicon Valley has grown and office rents have reflected the demand.

Commercial rents in Silicon Valley have increased by 15 percent in the past two years, averaging $5.43 per square foot per month, according to CBRE data, though some Peninsula cities rent for nearly double that amount. To put that into perspective, a 50,000-square-foot commercial lease would, on average, rent for about $3.26 million annually in many places in Silicon Valley.

But even as Silicon Valley’s popularity with tech companies continues to grow, many big giants are increasingly looking outside of the region for expansion space.

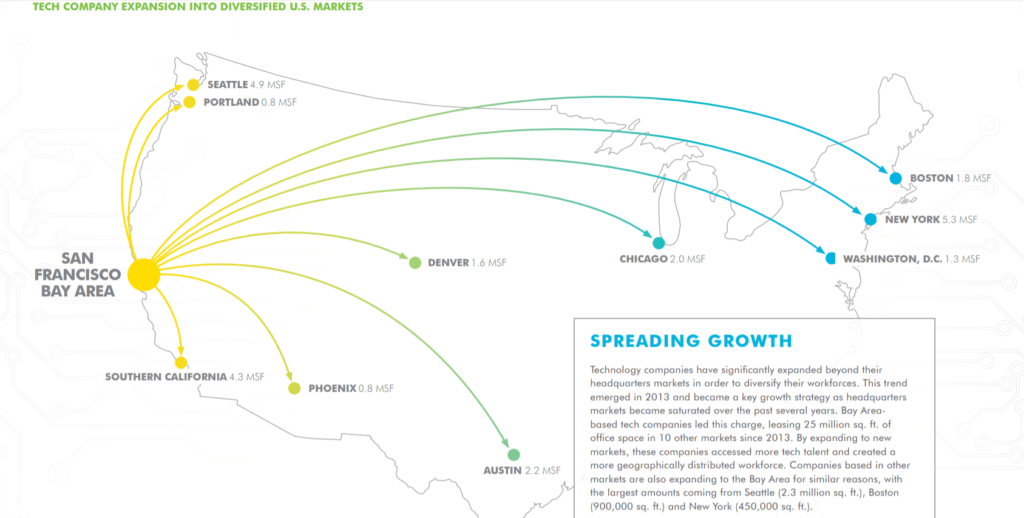

Since 2013, Bay Area companies have leased 35 million square feet in the region, but also another 25 million square feet of office space in 10 other markets, including Denver, Chicago, New York and Seattle, according to CBRE data.

“Tech companies in the Bay Area are doubling and tripling down on their space and their commitment to what they’re doing and their home, but they realize that they can’t just grow here,” Russell said. “They’re going across every time zone.”

And it’s not just companies looking outside of the Bay Area for talent and space. One recent report by EMSI, a Moscow, Idaho-based economic modeling company, suggests that talented tech workers are increasingly moving to parts of the country not traditionally associated with tech, particularly as the cost-of-living rises in major tech hotspots and remote work becomes more common.

But that may not be a bad thing, argues a recent Brookings paper, released this month, that makes a case for the government to get involved in promoting additional “growth centers” for tech across the country.

“It has become clear that while the future of America’s economy lies in its high-tech innovation sector, that same sector has widened the nation’s regional divides — a fact that became starkly apparent with the 2016 presidential election,” the paper notes. “The innovation sector has generated significant technology gains and wealth but has also helped spawn a growing gap between the nation’s dynamic ‘superstar’ metropolitan areas and most everywhere else.”

But for now, even as companies seek space and talent outside of the Bay Area, CBRE data suggests that the Silicon Valley market is in no danger of losing its place as a major tech hub, Russell said.

“Because we’re not the only market that has a low unemployment rate, that will be hindering the growth and the production,” she said. “So our GDP as a whole may slow, and it may be slower than it was in years past, but it’s still growing — barring any sort of unforeseen shock.”

Contact Janice Bitters at [email protected] or follow @JaniceBitters on Twitter.

Leave a Reply

You must be logged in to post a comment.