This year, the Santa Clara County assessment roll, which determines property taxes in Silicon Valley, hit a staggering $516 billion, buoyed by major tech companies buying land and opening major office campuses in the South Bay.

But that number comes with a caveat: Many of the same tech titans propping up the assessment roll also account for nearly 57 percent of the county’s $78.9 billion in active property tax assessment appeals. That means the roll, which has raised in value by 53 percent over the past eight years, would be much lower if those companies’ assets were valued at what they’d consider fair.

A three-member appeals board will decide whether the values in question will stick or be overridden during the appeals process. Reducing the assessed values means fewer dollars collected by the county in property taxes — ultimately impacting local school districts that rely on the sorely-needed funding.

The assessment tax roll is a tally of property values in the county. It outlines not only how much money property owners are set to pay in taxes on their land and the assets resting on that soil, but also acts as a bellwether for the Valley’s economy.

“The Silicon Valley office market closed on another record year, a much longer period of expansion than the ‘dot-com boom,’ 19 years ago,” Santa Clara County Assessor Larry Stone said in a recent statement about the assessment roll.

The unveiling of the roll in Santa Clara County marks the start of appeals season, when property owners large and small have the right to question whether the assessor’s office made the right call on their land. Each year between 4,000 and 5,000 appeals typically wind up back at the county office for review.

As of May, the county was reviewing 5,066 appeals. Residents and business owners were allowed to start filing appeals for the most recently released assessment roll on July 2.

Appeals: A breakdown

The bulk of the appeals filed annually are from homeowners or small property owners. Many are resolved quickly because they arise out of misunderstandings about property tax law, Stone said.

“Once they understand the system they’ll often withdraw it,” he said.

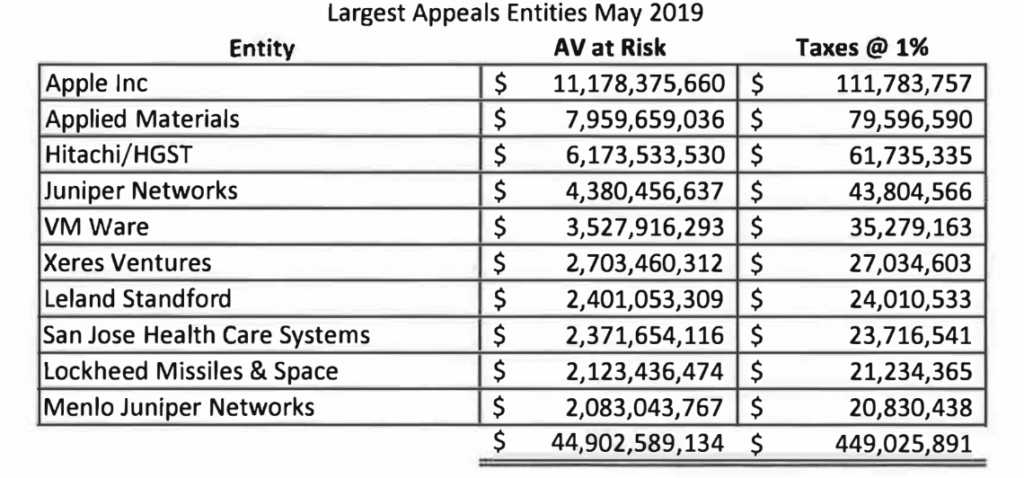

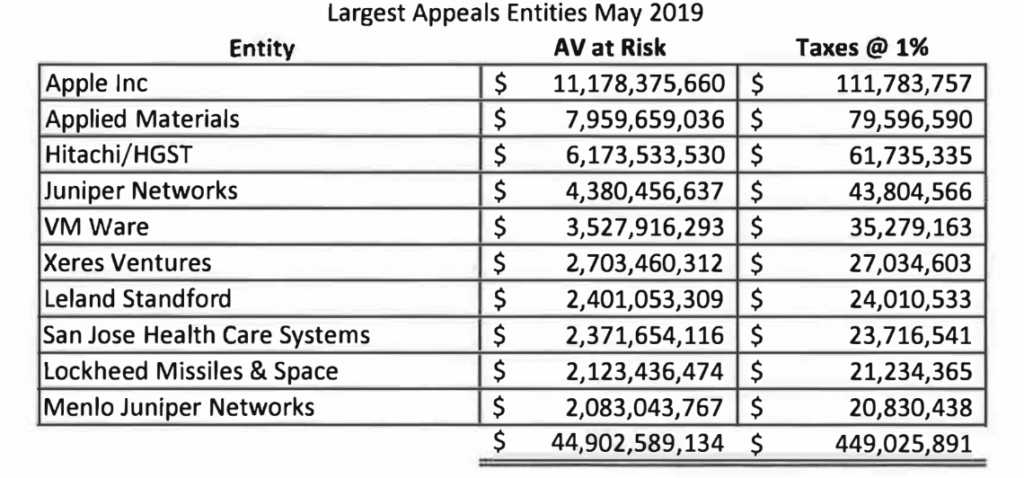

But when it comes to value, just 10 companies made up more than $44.9 billion of the county’s outstanding appeals as of May, according to the Santa Clara County Assessor’s office. Those 10 companies’ appeals are valued at around $449 million in potential tax revenue. Approximately half of the county’s property tax dollars go to public schools.

Chief among the companies appealing their assessed property value in Santa Clara County is Cupertino-based Apple Inc. The iPhone maker last year opened its 2.8 million-square-foot circular Apple Park “spaceship” campus, rumored to cost more than $5 billion to build in its hometown.

Apple has nearly $11.18 billion in outstanding assessment appeals, $3.2 billion more than any other tech company. A big part of Apple’s appeal comes from a question of how much Apple Park could fetch on the open market.

“They’re going to basically say, ‘Hey, this thing is well over improved,” said David Ginsborg, deputy to the assessor. “They’ll say ‘Nobody would pay for a spiral … elevator in a theater, and the theater is below ground.’ The point being is … there’s functional obsolescence.”

Santa Clara-based Applied Materials sits in the number two spot on the list, with nearly $7.96 billion in property assessment appeals currently outstanding, according to county documents.

Notably, Apple is based in Cupertino, but its property taxes primarily go to benefit the Santa Clara Unified School District, said Jeff Bowman, chief operations officer and business spokesperson for the Cupertino Union School District.

The district uses a model for funding that allows it to get much of its funding from the state based on the number of students enrolled. Even so, Bowman said property taxes play an indirect part in funding.

“Property taxes are important for the state budget,” he said. “So there’s an indirect impact … there’s always an impact.”

Representatives for the Santa Clara Board of Education and the Santa Clara Unified School District did not respond to a request for comment on its financing last week.

No compromises in property taxes

But Stone, who has been Santa Clara County’s assessor since 1994, said his calculations are agnostic when it comes to who will benefit or suffer. There’s no such thing as compromise when it comes to deciding the value of a property, he said.

“You either have a value on the roll that’s accurate or you don’t,” Stone said. “The assessor represents one thing and that is putting accurate values on the assessment role in a timely manner, and defending those values when there’s an assessment appeals file.”

That’s what made the recent — and highly publicized — lawsuit around the San Francisco 49er’s assessment appeal for its interest in Santa Clara’s Levi’s Stadium so noteworthy.

The board tasked with resolving such appeals, known as the Assessment Appeals Board, reduced the 49ers’ stake in the stadium’s value to the tune of $36 million, which would reduce its property tax contribution by about $6 million annually.

But the board, which Stone called a team of “quality folks,” didn’t offer up an explanation for how it decided the value of the NFL team’s stake in the stadium versus the city’s stake. That pushed Stone to lob his first-ever lawsuit against the volunteer body of local real estate gurus.

Stone said he thinks the complexity of the 49ers’ arrangement with the city around the stadium was a driving force in the decision.

“I think they threw up their hands and said divide it 50/50,” he said. “Legislators compromise … you can’t do that with value.”

On average the county retains about 90 percent of the value assessed annually. Last year, it retained about 97 percent of its assessed value in the settled appeals, Stone said. Many appeals can be handled informally, without a full hearing by the Assessment Appeals Board and without a lawsuit.

To appeal a 2019 property tax assessment, residents and property owners can visit that county’s website and opt to have their appeal heard faster via a Value Hearing Officer rather than the formal Assessment Appeals Board.

“I have the responsibility and putting out what we believe is accurate, valid value, but do we make mistakes? Yeah,” Stone said. “We over assess people we don’t want to and that’s why there’s a very simple and inexpensive [appeals] process.”

Contact Janice Bitters at [email protected] or follow @JaniceBitters on Twitter.

Leave a Reply

You must be logged in to post a comment.