A new report forecasting the real estate market in California shows a fairly sunny outlook for the Bay Area, though it notes the region may be facing some headwinds where it matters most: housing.

The report, called the Commercial Real Estate Survey, is released semi-annually by prominent California law firm Allen Matkins and the UCLA Anderson School of Management to gauge how developers feel about the market looking three years to the future. It tallies the types of projects developers plan to build in the coming years based largely on lease rates versus expected vacancy.

This year the survey showed a notable slump when it comes to multifamily development optimism, even as demand for new homes remains at a fever pitch in the Bay Area and tech companies show up with investments to help spur housing.

“In the last six months, Bay Area developers have pulled back on new (multifamily) development, and half of the panelists stated that they were not planning to start a new development in the next 12 months,” the report states.

That pessimism may be tied to “a growing movement toward rent control,” in the area, paired with rising costs to develop, the report added. Indeed, Silicon Valley developers and cities are reporting that housing projects aren’t easy to pencil, or make work financially.

Factors like rising land prices, construction materials and labor costs and in some cases city fees have hampered residential development in the past year. But notably cities like San Jose are already looking at ways to encourage approved residential projects to forge ahead.

“Whether we see a return to optimism in six months, I’m really interested to see because fundamentally the demand is there, but there are certainly headwinds,” said John Tipton, a partner at Allen Matkins.

Obviously, the report can’t tell the future seamlessly. But the survey has proven itself to be a decent gauge of what’s to come, according to a retrospective the groups released last year that compared past forecasts with building trends.

“Obviously markets are dynamic, so six months from now people might have a different view of what they’re seeing three years out, but this is their intent now,” Tipton said. “It has been a fairly accurate predictor of people’s actions following through on their intent.”

That’s significant because real estate often shows the earliest signs of weakness or strength as economists attempt to predict booms and busts. And murmurs of the next economic downturn have been creeping into Silicon Valley forecasts and fears for the past year. Notably, that’s not due to a slowing economy, but because history tells us that what goes up must come down, and the current economic cycle has been on an unprecedented run, with nearly a decade of growth.

It’s not unusual for city leaders across the Valley to air such concerns when weighing major development projects or rezoning efforts, including San Jose Mayor Sam Liccardo. Santa Clara County Assessor Larry Stone has told residents and the business community to brace for some sort of economic slowdown for the past few years, always with a wishful prediction of a “soft landing.”

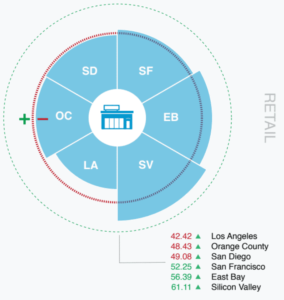

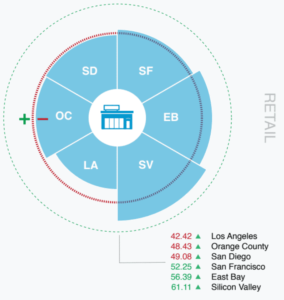

Even so, none of the usual indicators show a downturn is on the horizon. In fact, as the Allen Matkins and UCLA report indicates, the forecast shows an overall fairly sunny outlook for the Bay Area and across California — even in the struggling retail sector.

Though bricks-and-mortar is still suffering compared to a decade or more ago, developers and investors are feeling more optimistic as property owners begin to adapt to changing customer demands, which can be summed up fairly simply: “You better have some entertainment value or experiential idea in your retail space that makes it more interesting to visit,” Lew Horne, division president for the Pacific Southwest at CBRE said of the trend in the report. “People really want to have an experience.“

In Silicon Valley, retail has adapted to that trend in recent years.

Malls like Eastridge and Oakridge in San Jose as well as the Great Mall in Milpitas have already, or are currently undergoing, big revamps and welcoming new tenants. On the border of San Jose and Santa Clara, Valley Fair Mall is one of Unibail-Rodamco-Westfield’s best performing shopping centers in the country and is currently getting a more than $1 billion expansion.

Popular, mixed-use Santana Row across the street is often held up by urban planners across the country as an example of how to successfully build a shopping district as it continues to expand. Meanwhile, Related Cos. is working on a massive 9 million-square-foot mixed use district in Santa Clara that will include housing and office, but also critically plenty of new retail that officials say will become the city’s new hotspot.

On the office space front, the Allen Matkins and UCLA survey predicts that development may cool in the next couple years, and then will be back to firing on all cylinders in 2022.

But the real estate market is deeply interconnected. So how will the slump in optimism for housing affect the rosy outlook on retail and office?

Tipton says history shows the market often finds a way to balance itself out. Though for renters, it appears that may be a difficult balancing act.

“When the supply goes down, if the demand stays constant … prices will go up because it will be the same demand chasing less supply,” Tipton said. “When the prices go up, some of those projects that didn’t pencil in June of 2019, will suddenly start penciling in June of 2020.”

Contact Janice Bitters at [email protected] or follow @JaniceBitters on Twitter.

Leave a Reply

You must be logged in to post a comment.